Di tahun 2020 sampai 2021 awal ini, investasi semakin digemari dan semakin marak. Investasi seperti saham adalah produk investasi yang harus dimiliki. Dikutip dari Narasi News Room, influencers seperti Kaesang dan Raffi Ahmad gencar promosi atau endorse saham. Hal tersebut memicu geliat investasi di kalangan generasi milenial dan harga saham pun juga naik. Namun, seiring maraknya investasi, hal tersebut juga berpotensi memicu penipuan dan manipulasi pasar. Maka dari itu, sebaiknya jangan mudah tergiur oleh investasi terutama yang informasinya tidak terbuka untuk publik.

Apa yang dimaksud investasi?. Investasi adalah kegiatan menanamkan modal untuk mendapat keuntungan tertentu di waktu yang akan datang. Mereka yang memiliki pendapatan akan menyisihkan sebagian uang untuk modal berinvestasi. Modal tersebut nantinya akan memperoleh timbal balik yang lebih besar di masa depan tergantung investasi apa yang diambil. Maka dari itu, terdapat berbagai macam investasi yang dapat dicoba sekalipun pemula.

In English, investing or investment is how you trade money today for a lot more money in the future. According to the Listen Money Matters blog, the essence of investment is “high yield over the long term.” Investment can earn more money for you by doing long term savings. Not only through saving your money, but you can also buy an ownership share such as stocks and holdings to earn more money in the future.

The reasons why should we invest

Investment is a big financial move for you to build wealth and prosperity for the future. You can start with small amounts of money and build a portfolio for yourself eventually. However, people usually wonder why certain people such as the rich people and the like often invest their money even though they’re rich already? According to the Business Today page, besides wealth creation, there are some reasons why you should invest your money even though you’re already wealthy.

Wealth Creation

Investing some money in different assets will allow them to grow in terms of financial profit several years later. In this process, the rate or price of the investment asset increases over time. Some of the assets such as stocks, certificates of deposit, and bonds offer returns in long-term deals. By doing investment in return, the money is allowed to compound and automatically create wealth over time and raising the number of money that you can have in the future.

Beating Inflation

According to Trading Economics, Indonesia’s annual inflation rate inched up to 1.68% in December 2020. The increased rate of inflation also implies that we would lose money every year if keep our money in cash. Why? It is because of the decline of purchasing power of a money currency over time. What causes the decline of the purchasing power? It is the increase in the average price level of a particular product.

You can beat inflation by cultivating money in mutual funds. Indeed, the return from the investment helps maintain the purchasing power or the value of the currency at a constant level. However, if you don’t beat inflation, you would be losing money instead of earning money.

Retirement Corpus Creation

Investment results also create a corpus of funds that can be used when someone retires. The funds create a steady source of revenue for an investor when they do not have a source of income. Moreover, the funds accumulate over time and provide financial security to maintain a financially steady lifestyle after retirement.

Accomplishing Financial Goals

Investing is one of the ways to reach financial goals. By investing, you take steps to be financially secure for now and for your retirement. When you have set your investment for a long term financial plan, the returns can be used toward major financial goals. Those goals are buying a car, starting a business, or buying a house.

Tax-saving

The benefit of tax-savings is incorporating tax-saving investment into your portfolio which gives a head-start for the future. Some investments give double returns by providing returns as well as reducing taxable income. It minimizes the tax liability such as equity-linked saving scheme (ELSS) funds. Therefore, as you grow your wealth in the future, the earnings from the savings can serve your further requirements such as education, weddings, and retirement.

High Returns

Investing some money would get us high returns in the future when compared to the bank’s saving account. It is because the bank has an increased interest rate system that decreases your savings. However, investing in markets or investment products provides returns of 20 percent if given at the right time.

Things We Should Consider Before Making an Investment

As already stated, investment is one of the big financial moves for the future. People are saving money more than spending it, which slows down the economic pace. Therefore, they put some money aside for savings or emergency fund. However, should the money be saved or invested during a pandemic? According to the Today page, there are 4 things that we have to look for during a pandemic.

Ensuring your emergency savings

Making a decision to save or invest your cash money during a pandemic can be a difficult thing to do. However, living by yourself and earning money should make you think to put some emergency savings in this condition. An emergency fund is important as it allows you to live for several months if something unexpected comes up. The amount of funds that you need to stock before investing is the amount of three to eight months of your paycheck.

Moreover, the coronavirus pandemic causes the value of investment vehicles to decrease. Therefore, in the event of an economic crisis, you have to consider setting aside some extra money for emergency savings and some time to think about your job security.

Deciding the time for us to use the money

The emergency fund helps you to consider when and how the money would be used wisely. Once the fund is in the good shape, specify how would you spend the money you’ve saved and when to use the money. You have to think about what goals you wanted to reach by saving money.

If you want to use the money three to five years later or more, the money should be saved rather than invested. The short to medium-term savings should be considered to make sure how to keep the money. In this context, saving money in a high-yield account is profitable because of the higher interest rate.

Risk management during investing

If you have a healthy emergency fund and good financial planning, consider investing. You can check and calculate the risk of investment to reduce the ability of loss. Moreover, you can consider some factors such as age, time horizon, and the amounts of money invested.

People are actually avoiding the risk to lose their money in an investment. They feel they don’t have enough emergency funds or personal finance knowledge. However, if you are a novice, you can start looking into mutual funds, index funds, and exchange-traded funds. Those are less risky than choosing individual stocks. Moreover, according to Investopedia, mutual funds can also hold many different securities.

Counting the exact number of our cash money

Investment doesn’t need a big amount of money. You can start by saving 10 percent of your income aside. For example, saving for Rp. 25.000-Rp. 50.000 per week is a good habit to cultivate.

If you don’t have a lot of cash you can start investing with small amounts of money. Many Robo-advisers have advice and easy ways for you to start investing small amounts, even with spare changes. Those are platforms that provide services that are inexpensive and only require low opening balances, which makes them beneficial.

Saving a small amount of money is better than nothing at all. Therefore, when you can move it to a high-yield savings account or investment portfolio, then it will continue to grow.

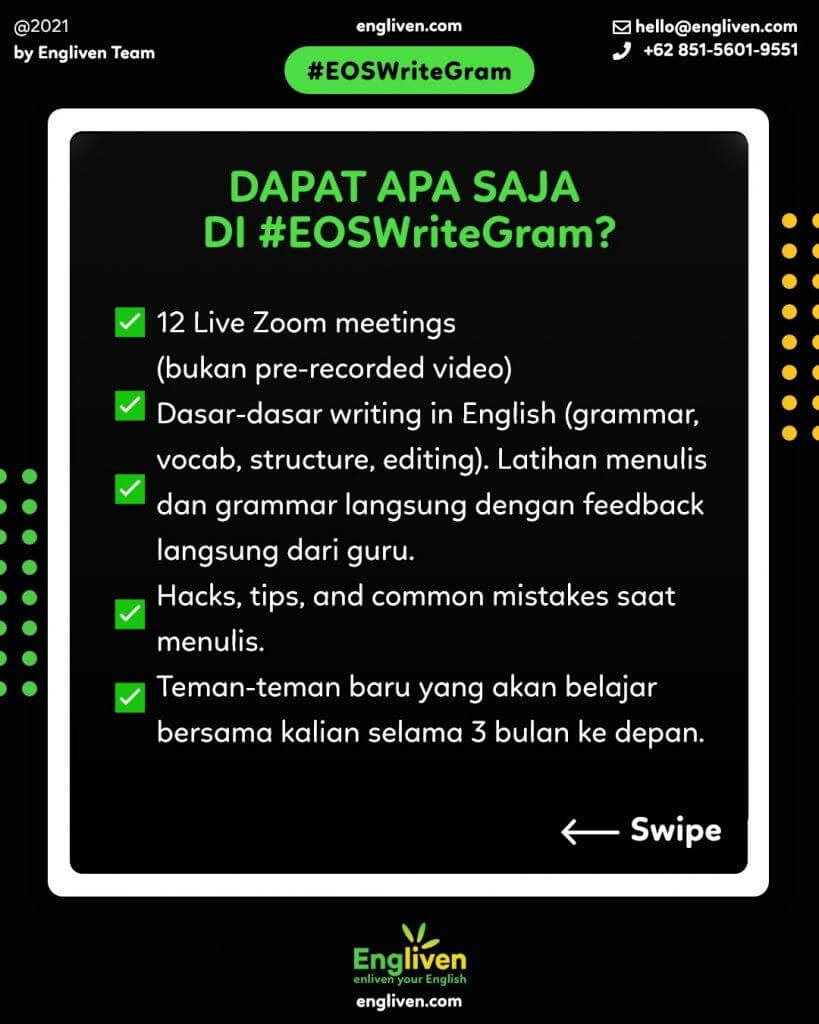

Apart from investing your money, you can try to start your business in 2021. Moreover, Engliven provides the opportunity so you can also invest your brain. It aims to enrich your knowledge by taking a course or join webinars. Not only that, it enriches your skill in speaking and writing by participating in the EOS (English Online Series) program.

Vocabulary Corner

If you have reached this point, do you have any questions about certain vocabularies in this article? If so, you can check the explanation below.

| English Words | Arti dalam Bahasa Indonesia |

| High yield | Hasil tinggi |

| Assets | Aset |

| Stocks | Saham |

| Bonds | Obligasi |

| Beat inflation | Mengurangi angka inflasi |

| Purchasing power | Daya beli |

| Mutual funds | Reksadana |

| Retirement corpus creation | Perencanaan modal pensiun |

| Revenue | Pendapatan |

| Funds | Dana |

| Economic pace | Kecepatan ekonomi |

And so, we have reached the end of this article. Now, have you earned a new interest to try investment in the future? If so, good luck in trying that! Also, we have other interesting blog articles for you to read as well. Happy reading!